Accounts Receivables Analysis

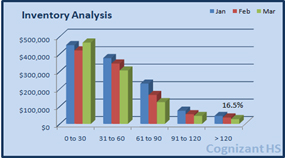

One of the easiest methods for analyzing the state of a company's accounts receivable is to print an accounts receivable aging report, which is a standard report in any accounting software package. This report divides the age of the accounts receivable into various buckets, which you can sometimes alter within the accounting software to match your billing terms. The most common time buckets are from 0-30 days old, 31-60 days old, 61-90 days old and older than 90 days. Any invoices falling into the time buckets representing periods greater than 120 days are cause for an increasing sense of alarm, especially if they drop into the oldest time bucket.

There are several issues to be aware of when you analyze based on an aging report, example…

- Individual credit terms. Management may have authorized unusually long credit terms to specific customers, or perhaps only for particular invoices. If so, these items may appear to be severely overdue for payment when they are in fact, not yet due for payment at all.

- Distance from billing date. In many companies, the majority of all invoices are billed at the end of the month. If you run the aging report a few days later, it will likely still show outstanding accounts receivable from one month ago for which payment is about to arrive, as well as the full amount of all the receivables that were just billed. In total, it appears that receivables are in a bad state. However, if you were to run the report just prior to the month-end billing activities, there would be far fewer accounts receivable in the report, and there may appear to be very little cash coming from uncollected receivables.

- Time bucket size. You should approximately match the duration of the time buckets in the report to the company's credit terms. For example, if credit terms are just ten days and the first time bucket spans 30 days, nearly all invoices will appear to be current.

*Acceptable performance indicator for greater than 120 day’s claims is between 15 to 18 %

Other Types of Analysis

- An interesting analysis related to accounts receivable is a trend line of the proportion of customer sales that are paid at the time of sale, noting the payment type used. Changes in a company's selling procedures and policies may shift sales toward or away from up-front payments, which therefore has an impact on the amount and characteristics of accounts receivable

Accounts Receivables Follow Up

Upscale Healthcare Billing Solutions(USHCBS) highly-trained accounts receivable follow-up team conducts extensive analysis of outstanding accounts receivables to strategize the right approach for insurance and patient follow-up, an approach most in-house billing departments miss.

These teams proactively follow up with insurance companies on claims open over 30 days to collect payment and improve cash flow. The result is more open claims and denials are paid in a timely manner.

In particular, USHCBS offers the following:

- Experienced, well-trained team that is successful at turning denials into payments

- Strong receivables follow-up on all claims 30 days or older

- Monthly analysis of all denials to generate reports identifying the problems

- 30-day aging report at the beginning of each month

- Root-level problem resolution report to help get more claims paid

-

Why USHCBS

Upscale Healthcare Billing Solutions(USHCBS) is one of the very few end to end health care business process outsourcing companies that offers from Medical Coding to Accounts Receivable follow up and Denials Management. You be rest assured knowing that the services are rendered by experienced professionals in our respective field.

READ MORE -

What We Do

We look for opportunities in all areas of our business to provide superior service, more extensive knowledge and performance above industry standards. Going above and beyond client expectations of a medical billing company is what Upscale Healthcare Billing Solutions strives for daily.

READ MORE